Overview of Token Metrics

What Are Token Metrics?

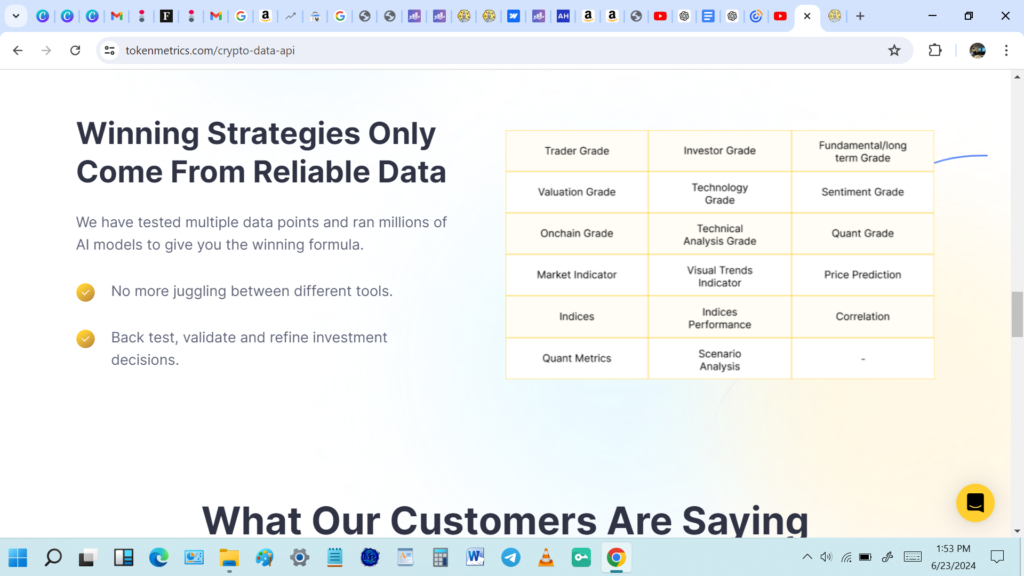

Token metrics encompass a range of data points that provide insights into various aspects of a cryptocurrency or token. These metrics often include:

Token metrics refer to the quantitative data and analytics used to evaluate and assess cryptocurrencies and tokens. In the dynamic world of blockchain technology and digital assets, having reliable and insightful token metrics is crucial for making informed investment decisions and understanding market trends token metrics best review

- Market Cap: The total value of a cryptocurrency’s circulating supply, calculated by multiplying the current price by the circulating supply.

- Volume: The total amount of a cryptocurrency that has been traded within a specific period, usually measured in 24-hour or 7-day periods.

- Supply Metrics: Details about the total supply of tokens, including circulating supply, maximum supply, and issuance schedule.

- Price Performance: Historical price data and charts showing how the token’s value has changed over time.

- Tokenomics: Economic models governing the token’s issuance, distribution, and use cases.

- Fundamental Analysis: In-depth research on the project, team, technology, and market potential.

Importance of Token Metrics

Accurate and up-to-date token metrics are essential for several reasons:

- Investment Decisions: Investors rely on metrics like market cap and trading volume to gauge a token’s liquidity and potential profitability.

- Risk Management: Metrics such as supply distribution and historical price data help assess risk factors associated with investing in a particular token.

- Market Trends: Analyzing token metrics can reveal market trends, investor sentiment, and the overall health of the cryptocurrency ecosystem.

- Comparative Analysis: Comparing token metrics across different cryptocurrencies enables investors to identify strengths, weaknesses, and competitive advantages.

By understanding and utilizing token metrics effectively, investors and enthusiasts can navigate the complexities of the cryptocurrency market with greater confidence and clarity.

Accuracy and Reliability

When evaluating token metrics, accuracy and reliability are paramount. Accurate token metrics ensure that investors and analysts are basing their decisions on trustworthy data, while reliable sources ensure consistent and up-to-date information review accurate.

Importance of Accuracy and Reliability in Token Metrics

Token metrics provide critical insights into the cryptocurrency market. However, inaccurate or unreliable data can lead to misguided investment decisions, increased risk, and financial loss. Here’s why accuracy and reliability are essential:

- Informed Decisions: Accurate token metrics allow investors to make informed decisions based on real-time and historical data, reducing the risk of errors.

- Market Analysis: Reliable data sources help analysts accurately assess market trends and investor sentiment, enabling better forecasting and strategy development.

- Trust Building: Consistently reliable data builds trust among users, enhancing the credibility of the platforms providing token metrics.

Factors Affecting Accuracy and Reliability

Several factors contribute to the accuracy and reliability of token metrics:

- Data Sources: The quality of data sources is crucial. Reliable token metrics platforms aggregate data from reputable exchanges and blockchain explorers to ensure accuracy.

- Methodologies: Transparent and robust methodologies for data collection and processing are essential. Platforms should clearly outline their methods for calculating metrics such as market cap, volume, and supply.

- Real-time Updates: The cryptocurrency market is highly volatile, so real-time updates are necessary to provide the most current data. Delays or infrequent updates can lead to outdated information and poor decision-making.

- Cross-verification: Cross-referencing data from multiple sources can help identify discrepancies and ensure consistency.

Examples of Reliable Token Metrics Platforms

Some platforms are known for their accuracy and reliability in providing token metrics. Examples include CoinGecko, CoinMarketCap, and Messari. These platforms use comprehensive data aggregation and verification processes to offer dependable information.

Challenges in Maintaining Accuracy and Reliability

Maintaining accuracy and reliability in token metrics is not without challenges. These include:

- Data Manipulation: Market manipulation, such as wash trading, can distort metrics like trading volume.

- Decentralized Data: Collecting and verifying data from decentralized exchanges and networks can be complex and time-consuming.

- Regulatory Changes: Changes in regulations can impact data availability and accuracy, requiring platforms to adapt quickly.

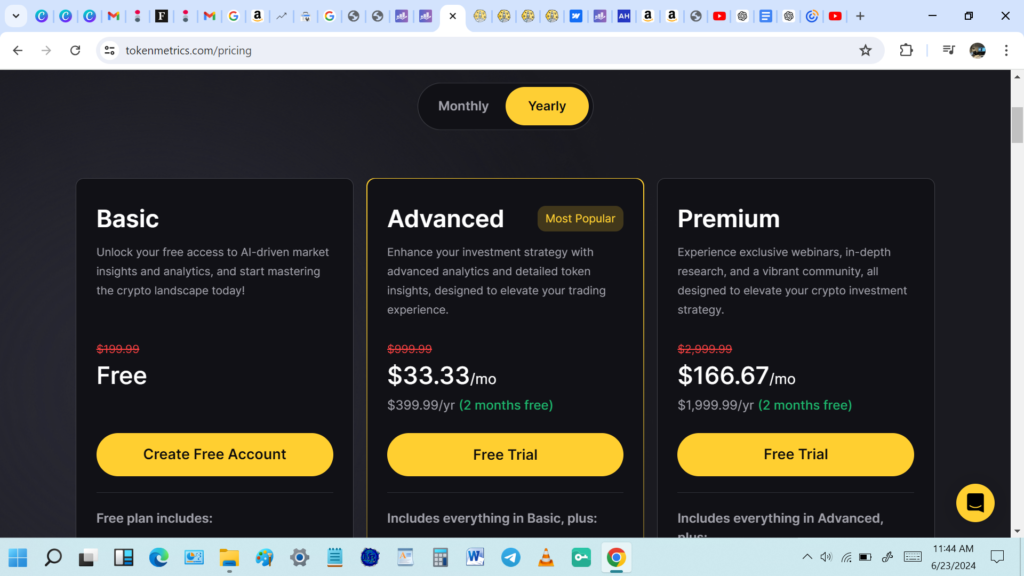

Pricing and Plans

When evaluating token metrics platforms, understanding their pricing and plans is crucial. Different platforms offer various pricing tiers to cater to diverse user needs, from individual investors to large enterprises. This section will explore the common pricing structures and what users can expect at each level.

Free Plans

Many token metrics platforms provide a free tier to allow users to explore basic features without any financial commitment. Free plans typically include:

- Access to basic market data (e.g., current prices, market cap)

- Limited historical data

- Basic charting and analytics tools

- Community forums or limited customer support

Pros: No cost, good for beginners

Cons: Limited features, restricted data access

Basic/Paid Plans

Basic paid plans are designed for more serious investors and traders who require more advanced features. These plans often include:

- Enhanced market data and analytics

- Access to additional tokens and cryptocurrencies

- More detailed historical data

- Improved charting tools and technical indicators

- Priority customer support

Pros: More features and data, affordable pricing

Cons: May still lack some advanced tools needed by professional traders

Premium Plans

Premium plans cater to professional traders, analysts, and institutions that need comprehensive data and advanced tools. These plans generally offer:

- Full access to all market data and metrics

- Advanced analytics and trading tools

- Comprehensive historical data

- Customizable dashboards

- Dedicated customer support and account management

Pros: Complete access to all features, ideal for professionals

Cons: Higher cost

Enterprise Plans

Enterprise plans are tailored for large institutions, hedge funds, and financial firms that require extensive data and customized solutions. These plans typically include:

- Custom data feeds and API access

- White-label solutions and integration support

- Advanced security features

- Dedicated support team

- Custom pricing based on specific needs

Pros: Highly customizable, extensive support

Cons: Expensive, requires negotiation

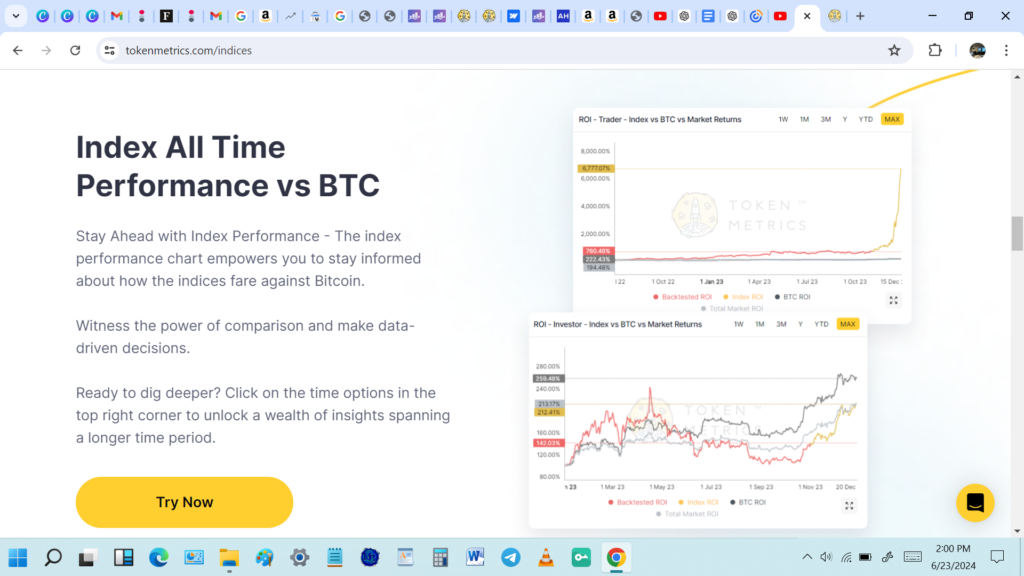

Performance and Speed

When evaluating token metrics platforms, performance and speed are critical factors that directly impact user experience and data reliability. The term “performance” refers to how efficiently the platform operates, while “speed” relates to the responsiveness and timeliness of data retrieval and processing.

Performance Metrics

Performance in token metrics platforms encompasses several aspects:

- Data Processing: Platforms should efficiently handle large volumes of data, ensuring that users can access real-time updates and historical data without delays.

- User Interface Responsiveness: A responsive and intuitive interface enhances user interaction, making it easier to navigate through different metrics and analyze data effectively.

- Reliability: Platforms should be reliable under varying load conditions, ensuring consistent performance even during peak usage times.

Speed of Data Retrieval

Speed is crucial in the context of token metrics because timely data can significantly impact trading decisions and market analysis:

- Real-time Updates: Users rely on platforms to provide up-to-the-minute data on prices, trading volumes, and market movements to make informed decisions.

- Historical Data Access: Quick access to historical data allows users to perform trend analysis and backtesting strategies efficiently.

Technical Infrastructure

Behind the scenes, robust technical infrastructure plays a vital role in ensuring performance and speed:

- Server Infrastructure: Utilization of cloud-based servers and scalable architecture helps in managing data loads effectively.

- Data Processing Algorithms: Efficient algorithms for data aggregation and analysis contribute to faster processing times.

Customer Reviews and Feedback

Customer reviews and feedback provide valuable insights into the effectiveness and user satisfaction of token metrics tools. By analyzing these reviews, potential users can make informed decisions about which token metrics product best suits their needs.

Importance of Customer Reviews and Feedback

Customer reviews and feedback are critical for several reasons:

- User Experience: Reviews highlight the real-world user experience, detailing how intuitive and user-friendly the token metrics tool is.

- Reliability and Accuracy: Feedback often covers the reliability and accuracy of the data provided by the tool, which is crucial for making informed investment decisions.

- Customer Support: Reviews can shed light on the quality of customer support provided by the company, which is important for resolving any issues that may arise.

- Performance and Speed: Users often comment on the performance and speed of the tool, which affects the overall user experience and efficiency.

- Value for Money: Feedback can indicate whether users feel they are getting good value for their investment, considering the tool’s features and pricing.

Key Points from Customer Reviews

When analyzing customer reviews for token metrics tools, several common themes tend to emerge:

- Ease of Use: Many users appreciate a straightforward and intuitive interface that makes it easy to navigate and analyze data.

- Comprehensive Data: Positive reviews often mention the breadth and depth of data available, including real-time updates and historical data.

- Customizability: Users value tools that offer customizable dashboards and reports, allowing them to tailor the metrics to their specific needs.

- Accuracy: Reliable and accurate data is a frequent highlight in positive reviews, as it is essential for making sound investment decisions.

- Support and Community: Good customer support and an active user community can significantly enhance the user experience, providing help and insights when needed.

Where to Find Customer Reviews

Customer reviews for token metrics tools can be found on various platforms, including:

- Product Websites: Many tools feature testimonials and reviews directly on their websites.

- Review Sites: Platforms like Trustpilot, G2, and Capterra aggregate user reviews and ratings for various software products.

- Cryptocurrency Forums: Communities such as Reddit, Bitcointalk, and specialized crypto forums often have discussions and reviews of different token metrics tools.

- Social Media: Twitter, LinkedIn, and other social media platforms can also be sources of user feedback and discussions.

By paying attention to customer reviews and feedback, prospective users can gain a better understanding of the strengths and weaknesses of different token metrics tools, helping them make more informed decisions.

pros and cons

When evaluating different token metrics platforms, it’s essential to consider both the advantages (pros) and drawbacks (cons) of each option. This balanced approach helps users make informed decisions based on their specific needs and preferences.

Pros of Token Metrics Platforms

- Data-Driven Insights: Token metrics platforms provide quantitative data and analytics that help investors and traders make informed decisions based on market trends, historical performance, and fundamental analysis.

- Comparative Analysis: Users can compare various cryptocurrencies and tokens side by side, evaluating metrics like market cap, trading volume, and price performance to identify investment opportunities and trends.

- Time-Saving: These platforms automate the collection and analysis of data, saving users significant time compared to manual research and analysis.

- Risk Management: Comprehensive metrics aid in assessing risk factors associated with different tokens, helping users manage their investment portfolios effectively.

Cons of Token Metrics Platforms

- Learning Curve: Some platforms may have a steep learning curve, requiring users to familiarize themselves with technical terms and analytical tools.

- Reliability Issues: Depending on data sources and platform maintenance, there may be instances of delayed or inaccurate data, impacting decision-making processes.

- Cost: While some basic features may be free, advanced analytics and real-time data often come with subscription fees or premium plans, which may not be cost-effective for all users.

- Over-reliance on Metrics: Relying solely on quantitative data without considering qualitative factors or market dynamics can lead to biased decision-making and missed opportunities.